One of the questions we get asked most frequently by Airbnb Hosts is, “Doesn’t Airbnb already cover me?”

The simple answer is no. While Airbnb does offer protection, that protection is not a substitute for a Host’s own insurance.

Airbnb provides its Hosts with two protection programs: The Host Guarantee, which is meant to protect the Host’s property; and the Host Protection Insurance, which is designed to protect the Host’s liability.

This sounds great, but there are drawbacks to each of the plans. Let’s examine them in more detail.

Host Guarantee

The Host Guarantee is not insurance. It’s simply a promise by Airbnb to repair or replace any property damaged by a Guest during a stay. There are many conditions that must be followed in order to qualify for the protection, such as:

-

The Host must attempt to settle the damage with the Guest, and that attempt must be done within the earlier of 14 days of check-out, or before the next Guest checks-in. That puts the Host in an adversarial position, causing anxiety and frustration - the exact opposite of the peace-of-mind provided by insurance. Plus, with back-to-back stays, this condition effectively precludes any coverage on the first stay.

-

The Host must have complied with all of Airbnb’s Safety Guidelines.

-

Airbnb must be notified of the damages within 14 days of check-out or before the next guest checks-in, whichever is earlier. This creates a very short reporting window.

-

The Host must first try to collect damages from other sources, such as their homeowner’s insurance policy, any other type of insurance, or a security deposit.

-

A detailed Proof of Loss form must be submitted within 30 days of incurring the damage, and it must be signed and sworn, and accompanied by an Airbnb Payment Request Form.

It’s important to point out that none of the conditions described above are required by property insurance.

There are another 17 conditions that Hosts must conform to in order to qualify for protection, including a “hold harmless” agreement in favour of Airbnb. We won’t waste time explaining that bit of legalese, but suffice to say it is not in the Host’s best interests.

Once qualifying for protection, the Host is subject to additional coverage conditions:

-

Property is only covered for its “actual cash value”, which takes into consideration the depreciation of the damaged property. For example, a damaged TV that originally cost $1,200 would likely be worth only $200 once its a few years old. By contrast, an insurance policy will cover the “replacement cost” of the damaged property, which means the cost of buying a similar item new. So, the Host would collect about $1,300 for that three-year old TV.

-

The limit of protection is only $1,000,000. That may sound like a lot, but what if a fire caused by the Guest destroys the home and all of its contents? What if the Guest has a wild party that trashes the entire home? At Slice, we’ve observed that over 50% of our customers carry insurance limits in excess of $1,000,000.

-

Fine Arts are restricted to the point of effectively not being covered.

-

Coverage for loss of income is restricted only to confirmed bookings lost as a result of covered damage to covered property, and of course only to bookings that were confirmed with Airbnb. An insurance policy will cover the Host for loss of both confirmed and potential bookings, and for bookings acquired from sources other than Airbnb.

In total, there are 29 limitations and exclusions, and 12 instances of excluded property - far more than most property insurance policies.

Host Protection Insurance

The purpose of the Host Protection Insurance is to provide primary liability insurance for Airbnb Hosts. This sounds good, and it’s certainly better than nothing, but we don’t recommend that Hosts rely on this insurance because of the restrictions and limitations to the program.

The limit of coverage is only $1,000,000 per occurrence and also carries a $1,000,000 maximum for the total of all claims at each listing location. This is insufficient in our opinion. By contrast, Slice provides $2,000,000 per occurrence with no maximum - and the limit is reset with every booking!

The policy is shared by all Hosts. On the surface, since the limit is $1,000,000 per occurrence, this doesn’t seem like a problem. However, the policy is most likely subject to a total maximum payout each year. With over 60 million Guests using Airbnb, there is potential that the limit of insurance could be used up by the time any one Host presents a claim.

Most importantly, the Host is not the “Named Insured” on the policy. The Host is only an “additional insured”. This means the Host does not own the policy and has no rights under the policy. The Host’s rights only extend as far as Airbnb is willing to allow. Claims must be submitted to Airbnb, and those claims will be managed and settled with Airbnb’s involvement. The only proper way to carry insurance is to be the Named Insured on one’s own policy, as that will ensure you are fully protected by the policy

Buy Your Own Insurance

The problems with Airbnb’s programs are not the fault of Airbnb. The insurance industry gave Airbnb no choice but to design its own protection, which is unfortunately inadequate.

Therefore, the only proper way for Hosts to protect themselves is to buy their own insurance policy, on which they are the Named Insured, and they are covered for their short term rental activities. One such option is Slice Insurance.

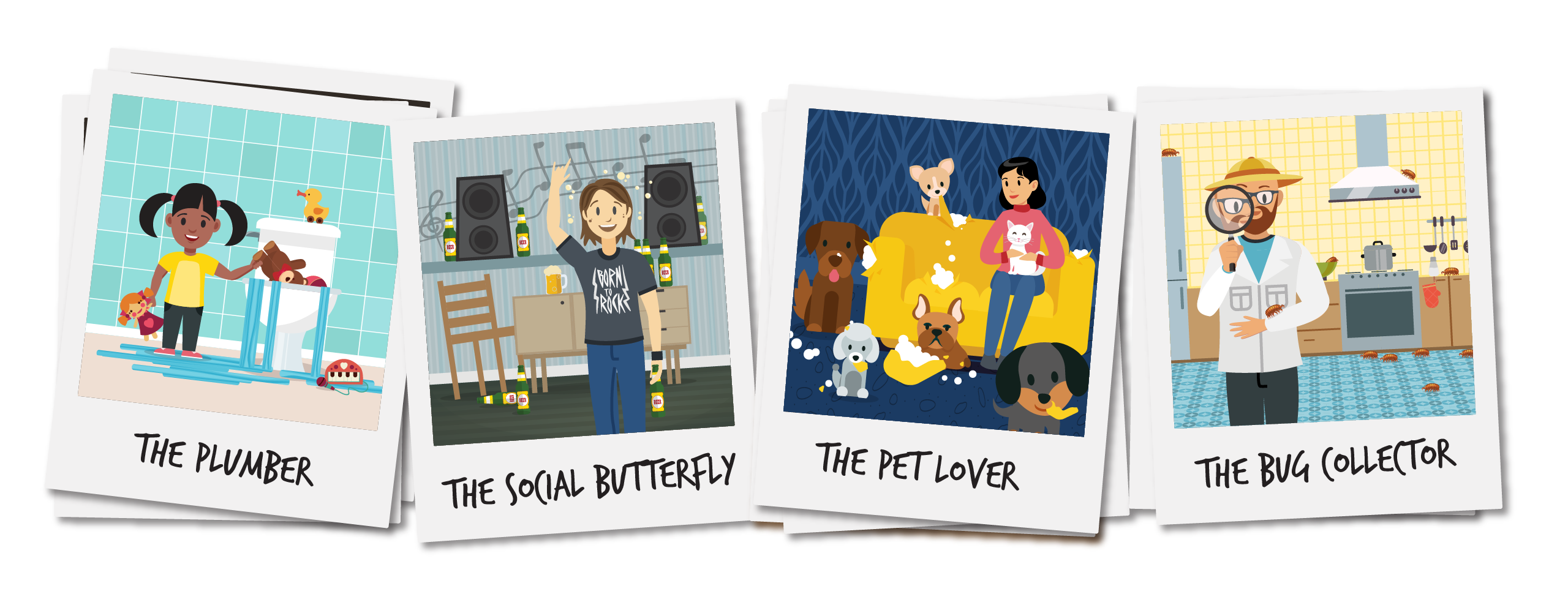

Slice provides on-demand, pay-per-use insurance to homeshare Hosts, so the Host never has to rely on Airbnb or any other homeshare company for protection. Our policy provides for replacement cost on property, protection against lost rental income, a $2,000,000 limit for liability and many specialty coverages designed specifically for homeshare Hosts, such as infestation coverage, all at an average cost of only $7 per day! Turn Slice on and off the same way that you do with your availability calendar. Slice was designed to work with hosts in a way that matches their life – only pay for when you are hosting while being fully protected, with the peace of mind that only true coverage provides.

To learn more or get started, visit www.slice.is/homeshare.

View this Slice blog post here.