Do you ever check the RATE you are charged for VAT / GST by the platforms?

I did and was very surprised. I travel a lot, and also have listings in five continents.

Airbnb

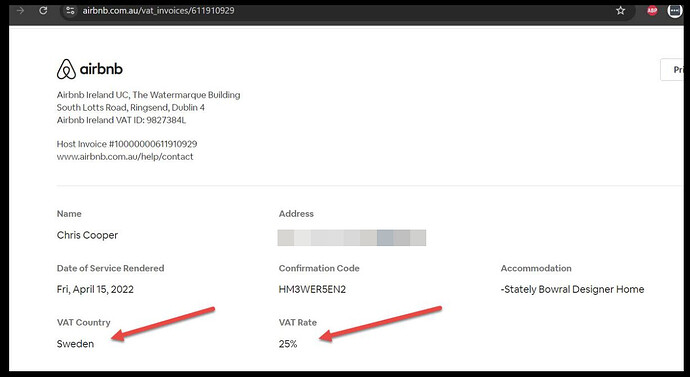

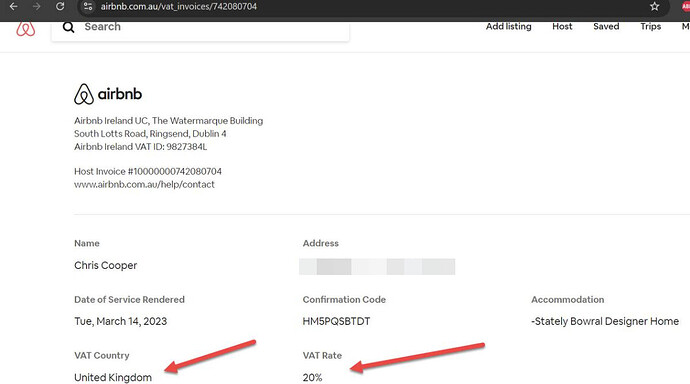

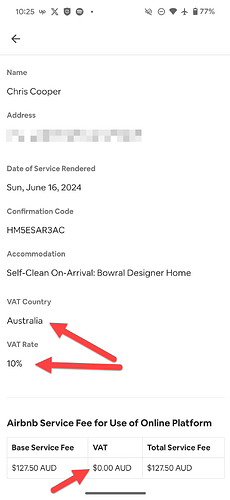

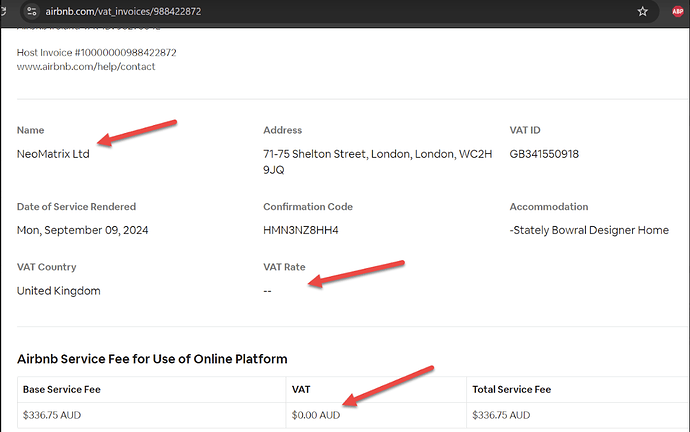

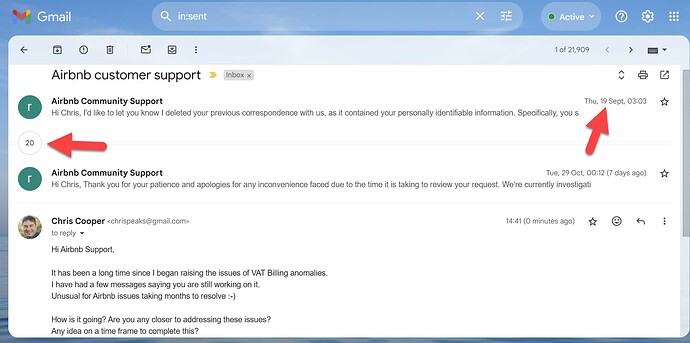

When I was running my account as an INDIVIDUAL, I was charged GST and VAT. The rate and ‘country of residence’ varied randomly between Australia, Sweden, UK and USA. My bills were 0%, 10%, 20%, 25%, and sporadically changed. Airbnb advised they ‘detect’ your country of residence using many signals. You can’t set it. They don’t tell you when it has changed. You can only check your VAT invoices to see the country and the rate they charged. Further, in some cases they charged the country as Australia, and the rate as 10% but the BILL was $0, where other times the rate is n/a. Weird.

Note Airbnb help does say VAT may NOT be charged to hosts in some cases (without clarity on exactly where/how), or to some guests - if they book as business travel with their own VAT.

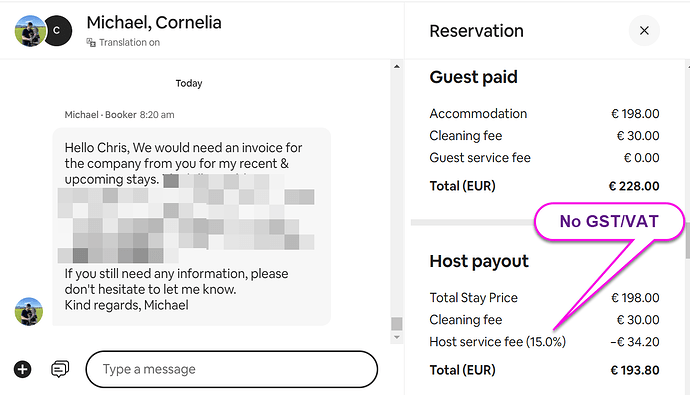

When I changed my account to a UK company run account, and uploaded my VAT number, Airbnb ceased charging me VAT or GST entirely. There is not even a bill to review. There is nothing. Just a 15% Host fee and no + VAT or PDF bill. So that is good, as I am no longer paying the fee. I THINK because I have foreign properties and the account and myself are not IN the country of these, so the ‘service’ is not taxable. I was not expecting this outcome, but it’s a significant saving of several thousand dollars a year in tax I no longer pay for using their booking service.

BookingCom

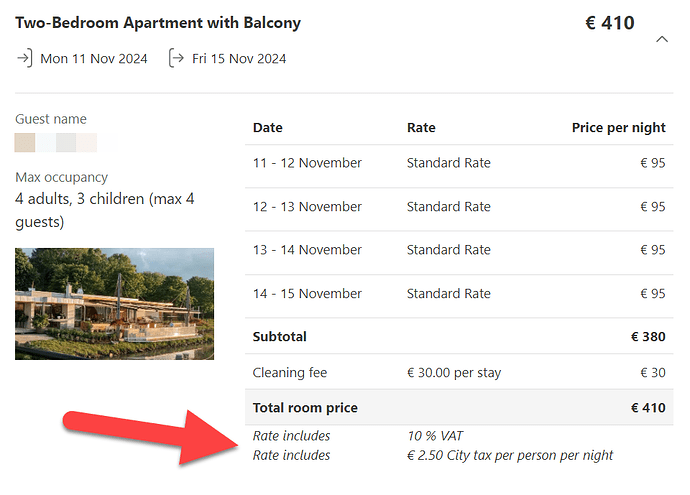

They STILL charge GST on my Australian bookings, and VAT on my EU or UK bookings. So odd that they charge tax when Airbnb does NOT charge tax to my company. They also charge a ‘City tax’ of 2.50 per guest per night and 10% VAT for my Austrian property, where Airbnb does NOT charge either of these fees. Weird.

Q1. Was anyone aware they can completely avoid VAT / GST tax in some cases, as Airbnb even list on their help site?

Q2. Anyone know why Airbnb and Booking.Com + VRBO seem to handle tax so differently?

Q3. I have had two guests recently ask ME for invoices. Seems hosts SHOULD provide invoices if requested, not the platform. But the question is - how much do I charge on the invoice for tax? Booking.com says 10% VAT is ‘included’, and the mysterious City tax - is VAT applied here as well? I don’t remit tax, so I don’t think I can claim tax on any invoice, else I am billing for tax that isn’t being paid to any government. This sounds very wrong.

I could not find any help in the forum on how to issue a guest invoice, but it’s the TAX aspect of such invoices that seem very unclear.

BookingCOM Payment details: