I am in Ohio and was just able to file yesterday for PUA. It will likely be pending for weeks because they need to verify my identity (their ID system with Experian was not working) so I’m hoping to get some info on how it may be going for other hosts in the US. If you have already applied, has your application for PUA been approved? What details can you give the rest of us? I checked the box for “my place of employment is closed due as a direct result of the COVID-19 public health emergency” because it seemed to be the only situation that was applicable. When travel restrictions are lifted, do you think they will allow our claims to proceed or will they disallow and say they are not responsible for travel and tourism being completely crushed because we will be ABLE to take reservations. What is your game plan going forward? If we do host during a week and report that income, does it mean we can get unemployment for the following week if we have no guests? I believe this is how it is supposed to work but who knows if that will actually be allowed. Thank you in advance for any helpful information!

@hickorycreek, I’m from Ohio, too. What occupation did you use when applying?

Yes, I was fortunate that my state was one of the earliest to open applications. I applied 2nd week of April and got my first payment 15 days later, with retroactive payment to Mar 27 coming the next week.

I can give a few but they may not be relevant to you because unemployment is done by the state and I am not in Ohio. There is a lot of variation state to state as states have a lot of leeway in both the interpretation of the program and in how they execute it.

We had only one box to check: “Is this due to Covid-19?”.

I’m not sure exactly what you mean by the question, but if you mean the initial claim, then yes. Your initial claim will be fulfilled and I just checked the Ohio site and the payments are retroactive - meaning you will get a lump sum back to your “unemployment” date. Your first payment will likely be for the week you applied, with the retroactive payments coming in the next week or two. The extra $600 is only retroactive to Mar 29.

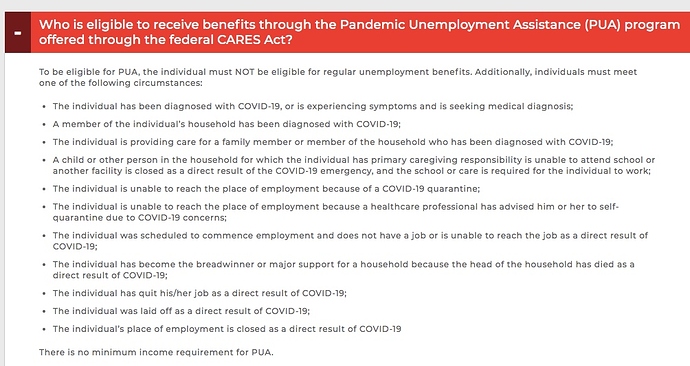

If you mean, will you be able to continue to claim once travel restrictions are lifted, maybe, maybe not. It will depend on your specific situation and whether or not you continue to meet the qualifications as interpreted by Ohio. Here are the exact qualifications from the Ohio site:

What struck me as interesting about Ohio’s list is the line about “the individual has quit his/her job as direct result of Covid-19”. Typically, that phrase includes “with good cause” but they didn’t include that there and I couldn’t find more about it, but it’s still likely that “good cause” would have to be established as the feds do impose some limits. In my state, “good cause” does not include merely being worried about catching the virus. They make a point of saying that. Ohio might be looking the other way though ,).

Here is a link to the related section of the actual federal legislation:

https://www.congress.gov/bill/116th-congress/house-bill/748/text#HA1D336676A2942D88E0684EA42716809

You can see that there is plenty of wiggle room for state’s interpretation and execution of the benefits. Some states are applying the same rules as they have for regular unemployment and some are being a bit more expansive or limiting for the PUA benefits.

FWIW, I have gotten involved in helping a lot of different people from different states and Ohio’s website and plan seems better than most. It may be of benefit that they spent more time organizing everything before allowing the applications. Some of us were able to apply much earlier but it was quite the clusterf*ck ,)

Of particular interest on the Ohio website was this statement in their FAQ for the PUA:

It’s not to imply that you are in any matter a real estate agent, but it does point to Ohio being more expansive with the benefits as opposed to more limiting. “Severely limited your ability to continue performing your customary work activities…” leaves a lot of wiggle room.

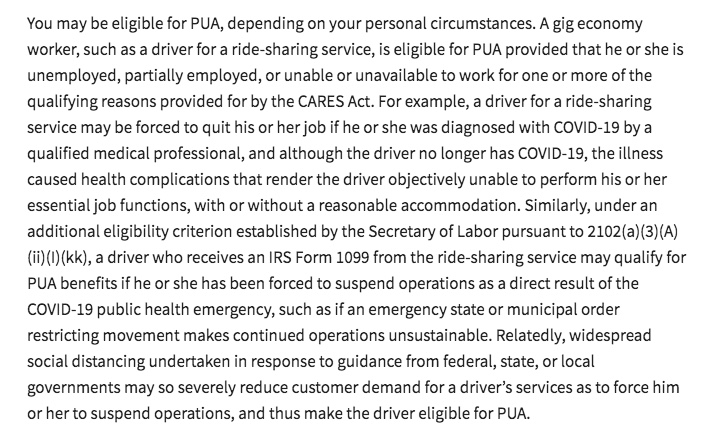

Even the fed’s have a lot of interpretation of their own bill. Here’s an example from the fed’s FAQ regarding the PUA. The example is a rideshare driver, but the last sentence is of particular interest and easily applies to hosts too:

(this is from this fed page: https://www.dol.gov/coronavirus/unemployment-insurance#fact-sheets )

But the real question is about the specifics that qualify that statement. E.g. does their have to be a government mandate regarding travel (people can’t come to my airbnb)? or just regarding distancing (it’s unsafe for me to have people at my airbnb) ? or is the fact that people aren’t traveling because of covid enough (there aren’t any people at my airbnb)?

Ohio, overall, seems to be particularly generous in doling out these benefits, after researching on their state site. It bodes well for you.

Yes, typically, but I couldn’t find it actually stated under Ohio’s PUA program; however, it is of course stated in their regular unemployment program and is within the fed’s rules so it’s safe to assume. I only mention it because it was odd that it wasn’t addressed, though it’s probably because they are just getting rolling with it. Whereas my state is now publishing “when you return to work” information.

I chose “Lodging Manager”

Thank you so much for your well-prepared thoughts!

I think my brother has been scammed. He said that he received a lump sum of $9,000 in his checking account after completing an application at a supposed .gov unemployment site.

Does that sound right to you?

It’s possible. You can start collecting for unemployment starting on March 15, and with your state UI + $2400/month Covid UI it could add up to that much or close to it.

My understanding is that they are doing that because it took so long to create a completely different parallel unemployment claim system in each state, and some systems can’t handle the large number of folks filing claims, resulting in long payment delays.

It sounds like retroactive payments. So, if he applied on June 12 but has been unemployed since Mar 16, then he could be owed that much. Alternately, he may have applied Mar 16 and has just now been processed and then also is due that large sum.