Well it looks like AirBnB is finally staring to collect local taxes in Hawaii – but they’re wrong! I looked up my own listing today and for a total cost of $440, they tax line was $2. It’s supposed to be about 14% (9.25% occupancy tax and 4.712% General Excise Tax). I sent an email to AirBnB but is this how they roll? Add something that is just absurdly wrong and then fix it later?

Oh no! I’m in Kona and haven’t seen any mention of that! Did you get an email? I can understand if they collected just the TAT but not the excise, which you might still have to get from the guest. I just don’t see how they could collect the wrong amount! Keep us updated!

go straight to the airbnb help on twitter they will respond quickly we had something like that here in Miami with confusion about reporting taxes and within a day we got the answers we needed.

Even if they were only collecting the excise, it should be $20.73 on that amount. Did they get a decimal place wrong? How will this be reported on our returns?

I have no idea Kona, I am not sure how they could make that kind of mistake. Maybe they are only including the .05% rail surcharge :)? How can they get it off by orders of magnitude?

Thank you for the suggestion Carmen. I guess I will have to fire up my Twitter account. It’s hard to understand how they can be so sloppy when a simple google search will tell them what the correct tax amount is.

Manoa, if you read Billy Bob’s post about Florida’s tax collecting fiasco, it appears that Air is not crediting hosts’ accounts with the tax… meaning you are still liable to collect them!??

This was only upon looking up your listing but not in actually booking a guest? Very disturbing… and why wouldn’t they start collecting for the whole state, why just Honolulu?

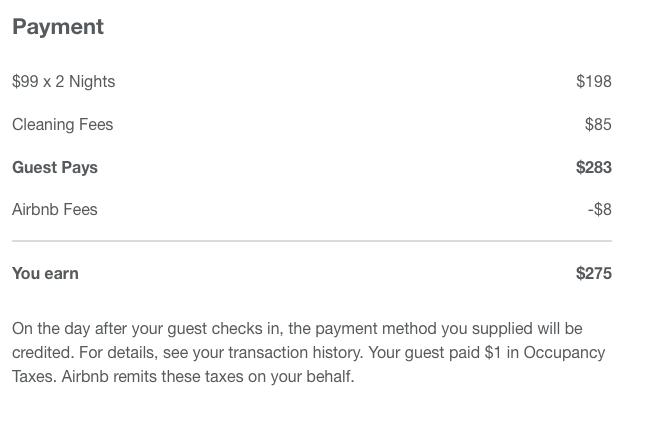

AirBnB replied that they are only collecting GET on THEIR fee amount! Doesn’t that stink? So the guests think that they are paying the taxes, but all they are collecting is the amount that the corporation owes, not the hosts at all!

Here is their reply:

Thank you for contacting us. I apologize for any confusion.

We are not currently collecting TAT or occupancy tax in Hawaii. The tax that we are currently collecting is a general excise tax, which is only applied to the guest service fees. This should not change the way that you collect any taxes which you owe.

I hope this clarifies. Please don’t hesitate to let me know if there is anything else I can do for you. I will be more than happy to help!

All the best,

Greta O

I was just thinking about your question, because I noticed the same thing on a correspondence from them! The guest was charged $1 tax when they actually owe $36.98!!!

So it is THEIR excise… which they should be exempt from since WE are collecting it from the guest! The guest is paying tax twice!

That is excise pyramiding if I’ve ever seen it!

I don’t think that we are collecting excise on the AirBnB fee because Air keeps it and doesn’t give it to us.

Here is what I think we owe, as far as I understand. I read that we don’t have to charge TAT on the room cleaning, it’s just the room charge. So say the room rate is $100, the cleaning free is $25 and AirBnB charges us (the host) a $5 fee on this transaction. Then the total that the host collects would be $120.

Of the $120, $25 is subject to 4.712% GET only (cleaning fee), and $95 is subject to TAT+GET (TAT is 9.25%; room rate - Air fee).

Then the net amounts are

Room Rate: $95/1.13962 = $83.36

Cleaning fee: $25/1.04712 = $23.88

TAT on room rate only = $7.71

GET = $5.05 ( $1.12 on cleaning fee and $3.93 on room rate)

total = $120

I read that if you itemize it for the guest to show that all taxes are included, then you can avoid paying tax on the tax.

However, everyone should check for themselves of course because I’m not a tax professional.

I collect tax on everything though because you have to collect excise on the gross amount you earn. Have you seen or heard somewhere that the cleaning fee is exempt? It’s still income that you make, correct? And if it is exempt, how do you itemize it on the back of your return?

I think Hawaii is still pretty backwards about taxes. They really should have allowed Air to collect the wholesale rate of .005%. Since they are the, quote, middleman in this transaction

I haven’t done the math, but maybe that’s what this is… The wholesale rate!

The cleaning fee is not exempt, it is just not subject to the TAT (transient accommodations tax). Only the room rate is.

We are not collecting the taxes in addition, we are taking it out of what we get from AirBnB. We do that because the guests will just have a bad feeling if we ask them for more money on top of what they already paid at the time of transaction, it’s only human nature. That’s why I was working on figuring out how to calculate it so that what we get from AirBnB is inclusive of all taxes. I wish AirBnB would allow us to add the local taxes in but it is ridiculous that they do not.

I think what Air is doing and presenting to the guest is collecting GET on only their transaction fee (that we never see – the 10% or so surcharge that they charge the guests). It could also be the wholesale GET tax rate on the entire transaction (1/2% on the whole amount comes out very close to 4% of 10%). But isn’t this wrong? Lord knows I may not understand Hawaii tax law, but I though that vendors always have to collect GET on the gross receipts, which would mean the whole amount. They can charge the wholesale rate if they sell it to someone else who then collects from the consumer, but this wouldn’t apply to their service fee. So they should technically be collecting 0.5% of the entire transaction (minus the service fee) and 4.712% on the service fee.

But the bottom line is that they’re not doing anything to help hosts with tax liability, and potentially confusing the guests (it’s called “local occupancy tax” on their end, which is completely wrong.

Ok, are you sure that the cleaning fee just doesn’t become “absorbed” by the room rate? That’s how Air sees it. When they itemize my room rate per night, they include the cleaning fee as part. So on seven nights @ $100, I’m at $785 before Air commissions… Where did you read or hear it? Not disputing you, just wanting to know where you read or heard this? Just want to cover my bases come filing time!

Hawaii is unique with its excise tax, in that it is a tax and goods AND services. Cleaning is a service… No other state has this, I believe. And there are varying levels, as you mentioned.

So for example, I just filed my return.

I filed on $8092 semi-annually for Air income. I paid excise of 4.0% and TAT of 9.25%. I bundled the whole thing and wrote one check. This was money collected from the guest at each booking. If I didn’t collect it, I’d owe it out of my own pocket. Yikes, as it was over $1000.

On another line, I reported self-employed income from Random House, NY… EXEMPT, as it is work for out of state clients.

On yet another line, I reported income from Hawaii-based clients at the wholesale rate, since my client has a wholesale license. (The wholesale rate was put into place to relieve the pyramiding, as well it should! )

So three different types of excise income, three different rates! And TAT a different return altogether.

I agree on the Air and the wholesale tax rate… Now that I read your reply from Air, I see what’s happening. Air is collecting tax from the guest on their fee at the wholesale rate. They wrongly term it “occupancy” tax here, when it is NOT. It’s Excise. Air does not remit them on our behalf. Not in Hawaii.

’

I think that wording is what got us confused!

See below.