We have our AirBNB property in Bradenton Florida USA and we are being told that the shorter the stay (1-nighters, 2-nighters or 3-nighters) limit the number of insurance carriers who would insure the property. They prefer 1 week minimum. There are carriers who won’t consider less than 1 week.

Any suggestions on insurance. Does AirBNB cover any liability and how good is it?

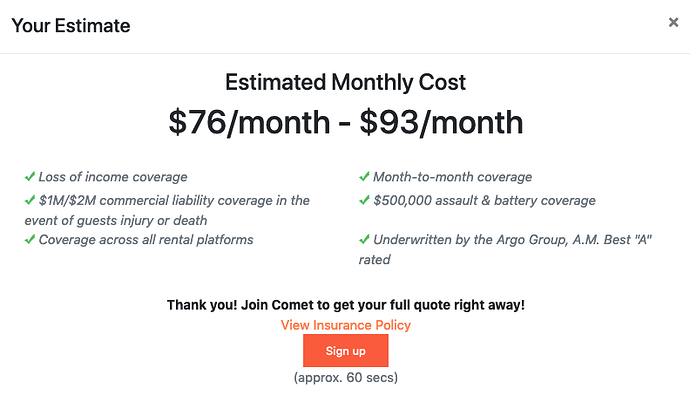

I went on Comethome.com and got a quote.

What do you think? Is this a good idea/price. I am confused about how to proceed with insurance. I have basic homeowners policy the cover the property and contents. Is this necessary or overkill with the AirBNB coverage?

Short-term rental insurance is necessary. Homeowner’s coverage will not honor claims for damage or theft caused by short-term renters. Airbnb coverage is, at best, unreliable,

Proper and Travelers are two companies that do STR. Suggest looking into both of those. We just got Travelers and it was cheaper than the regular insurance, believe it or not. And we are a waterfront property which adds other kinds of risks.

We have short-term rental insurance that was added as a rider to our regular homeowner’s insurance. It caused our homeowner’s insurance to go up about $500/yr. We have Traveler’s Insurance. We had our insurance agents determine the policy based on our needs so we didn’t shop around on our own.

I don’t know anything about landlord’s insurance. At first glance I would think that was more for long term rentals but I have no idea! Now you have me wondering if our policy is thorough enough. I’d be curious to hear more.

I’ve no idea about landlord insurance either but yes, you definitely need STR insurance. Is the price quoted above for genuine STR insurance? It seems very reasonable if so, but I realise it depends on a lot of factors.

Probably the best way to so it, rather than online, is ask your broker. He / she knows more about your personal circumstances and will shop around.

Landlord insurance? Simply the cost of doing business. You want to rely on Airbnb having your back…?

JF

You absolutely do need separate STR insurance. The AirBnb Host Guarantee isn’t worth a thing!

If your homeowners insurance company finds out you are doing STRs, there’s a very good chance they will cancel you outright. As they did to my partner when we decided to start doing Airbnb.

I think you are being misled. At least down the coast here in Fort Myers, the idea that shorter stays limit the number of insurance carriers is simply not true. What DOES limit you, at least here in this county is the fact that we are in Florida, and there are darn few insurance carriers who will insure you at all, compared to say being in Ohio or Iowa. There are these things called “hurricanes” that very few companies want to insure against.

Proper was our worst quote. Oh it was only $1500 per year. But there was no “wind policy” – no hurricane coverage. You want that? Oh, that’s an additional $5000 per year all by itself because you live in Florida!

And we Floridians definitely need flood too.

Only for a few more years, then you will need a houseboat…

RR

This coverage is in addition to your regular homeowners policy. Ours HOP is $1337 a year and this would add the extra liability for STR.

Every location has different requirements depending on the city, state, etc. I ended up going with a local broker in Massachusetts which wrote me rather mid level coverage. I was intrigued by Slice Insurance which is very specific to short term rentals. This is not an ad for their product, but I found it to be a unique approach - you only get insurance for the booked nights. I’m not sure if other companies offer this option. Every insurance company has different caveats too. Mine, for example specifies that I’m not to rent to students but I don’t always know that when booking on Airbnb.