I earned $4,193 with airbnb in 2015 (of course, it was more than 2 weeks renting). I don’t own the 2 properties (one in USA and one in France), my parents do, so I didn’t pay any property expenses, my parents did. Should I declare it as a rental income (it seems complicated), or because I’m self employed as an eBay seller, can I just add airbnb in form 1040, “other income worksheet”?

Unfortunately, you cannot just report your Airbnb earnings on the other income column of the Form 1040. In general, your Airbnb operation is viewed by the IRS more as a business activity than a rental, and as such the earnings is subject to self-employment tax.

You will need to report your Airbnb earnings on a separate Schedule C from your eBay earnings. Make sure you deduct the 3% Airbnb fees as well as any Airbnb related expenditures like cleaning fees, supplies, furnitures, etc. to lower your tax liability.

If you need more information, we’ve written the 5 Simple Concepts for Airbnb Hosts to Avoid IRS Audits:

Good luck!

I am totally not sure now. I just got back from the CPA in a bit of shock. I own my home, and my CPA told me Air could not be looked at like a Schedule C. That the IRS take a stringent eye on what constitutes a B&B business and what constitutes renting your house on platforms like Air. I would have to be a regular licensed B&B with all that entails. Simply renting my studio on Air does not count as a B&B.

This was a shock to me as I fully thought I could expense it like a Schedule C, but no… it could only be a schedule E, which is rental use of your home… Same as if I rented long term.

So it looks like the sad answer is that you will be fully responsible for the taxes due. Fortunately that is not a huge amount this year. In the future, you may want to put something like 20% aside of each booking, and send it into Uncle Sam quarterly. If it ends up being too much, you can always get it back.

I would take this to a CPA and not try to do it on your own. The CPA might be able to find ways to make this work to your advantage.

Hi konacoconutz. Thank you for sharing your experience with a CPA. We’re an accounting firm and our CPAs have many years of experience in taxes and accounting from one of the largest accounting firms in the world. Unfortunately, not all CPAs are created equal because of specialization and industry knowledge. We mostly specialize in Airbnb taxes, and one of our CPAs is also an Airbnb host.

Did your CPA cite any regulations or perform any analysis on the number of average rental days? It’s true that historically taxpayers have tried to offset their passive losses against their ordinary income, and that’s why the IRS is strict BUT Airbnb is different than any businesses that have been regulated in the past. This is the reason why citing the regulation, knowing the exception to the rule, and performing a detailed analysis based on a client’s specific fact pattern are important aspects of our profession.

One potential concern with a similar situation is that IF someone get audited three years from now (knock on wood) and the IRS rule that their Airbnb income should be reported on Schedule C and not E, assuming they made a profit, they will owe back taxes, penalty and interest from failing to pay for self-employment tax on Airbnb earnings. Looking forward to your response.

Levee…I don’t think so!!! I am sure she has seen clients come in with AirBnB income but I doubt she was up to speed on the regulations you are talking about here. I had under 20K and under 200 bookings. Yet, I still collected TAT even though now, the rental was taken off my taxes as a regular rfental schedule E. Not a transient accommodation.

So I guess that is one thing I am not getting! Why should I collect TAT if it is a regular rental? Better ask!

As for this year, it’s already filed and done. But I would like to know for next year!

Oh… I pay self-employment on my other income… the writing business income… and have traditionally qualified for the EIC! Not this year though.

These are great points! Traditional rental properties are not subject to TAT. Did you or Airbnb collected TAT from transients (aka guests) or is it coming out of your own earnings? Because that amount should be excluded from your gross income and you shouldn’t pay tax on it.

We would be happy to review your filed returns and supporting documents free of charge. If we find any error or find more tax savings, then we’ll let you decide if you want us to file an amended return. Get in touch with us at www.getlevee.com/tax

Another question: Air sent me a notice that because this year I made under the 20K threshold I would not receive a 1099K. I looked just to be sure and didn’t see one attached to my account. Why would they do that? Wouldn’t the IRS want all the income from this home sharing to be reported? I know they’ve sent 1099s all the other years I’ve done Air. But not starting with 2015.

Do you guys do taxes for all the states, even Hawaii?

I think that I’m a different case than konacoconutz because I don’t own the properties, I didn’t pay electricity, maintenance fee and tax property for it, it’s just my parents helping me out. So I think second schedule C is good enough for me.

Good question. The IRS has always had this threshold rule for many years but Airbnb didn’t know any better. Now they hired a knowledgeable public accounting firm who probably advised them to save on cost (sending 1099 forms to thousands of hosts is expensive and huge labor costs).

We prepare taxes and provide consulting services for all 50 states, even Hawaii.

I collected it, and they did exclude it. I will ask her about the TAT. You are supposed to collect it from any rental under 180 days per year. Also, in Hawaii we have to collect and pay excise tax (4.167%) in addition to TAT. All of those tax accounts are linked and must balance to your fed and state returns, adding more complication!

What do you charge to prepare a return?

We charge a flat fee of $250. We’re here to educate hosts and help them avoid a potential audit and not try to overcharge for our services just because the topic is complicated. We think you either know what you’re talking about or you don’t. We’ve helped other hosts on audits before and it’s a stressful situation that can be easily prevented.

We’re a great partner because we’re accessible throughout the year and we strive to find ways to stay on top of regulations and make hosts lives easier.

Stay tuned for our tax app for Airbnb hosts. We want to automate the entire tax process from tracking and categorizing your business expenses to filing your returns with our accountants. We’re here because we want to solve the old tax process and were looking for ways to automate and make taxes affordable. (That’s our speech on why we think we’re a cut above the rest)

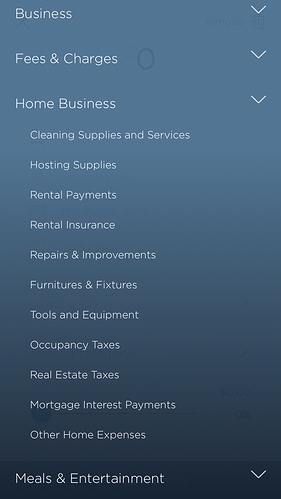

Here is a preview of the hosting expense categories.

Very good to know. Do you do returns for strictly Air income or other incomes as well? I cobble together a living from several other sources… Plus I have the excise thing to deal with! It may be more trouble than it’s worth for $250. Plus I just forked over $275 for tax work.

I like the app! That’s really cool!

Sounds good miamiparis. As a self-employed, if you’re looking to get the most tax refund/savings from your Airbnb and eBay operations, you can hire our accountants and/or use our tax app.

Cheers!

Thank you! If you’re interested in joining our exclusive group of select early access users to provide feedback and influence the direction of the app, please email us at hello@getlevee.com and we’ll set you “app”.

No, we’re not strictly preparing Air income. We know that most hosts have other sources of income from employment, school, investments, self-employment, etc., therefore, we prepare income taxes for individuals and businesses.

The general excise tax (“GET”) is separate from income taxes and is due monthly to the State of Hawaii based on your earnings. This is a bookkeeping function that requires more time and effort throughout the year that we would be happy to help you with.

As for the tax return prep fees, please email us and we can discuss further.

Yes, GET is something I’ve been doing for the 24 years I’ve lived here. Now I’m just collecting TAT along with it. Separate return but can just be paid for all together. Depending on how much you owe, it can be due quarterly, monthly, or semi-annually.