How do we get from GROSS to net using the two download options we have for transactions?

I have had this same issue every year, and other issues. I have asked airbnb every year to provide a better tool for hosts. Quite simply, if they would put in exactly what shows on the guest’s invoice and then identify taxes collected separately (I have state and county) and the host fee it would be honest, simple and an actual tool for hosts. As it is I often cannot get the gross amounts to equate to the payout. I have posted this a couple of times but I believe it bears raising it up again as airbnb has yet to address my requests, and I am guessing I am not the only host asking for a true, gross to net printout at tax time.

GROSS is the amount of income you receive from Airbnb before the host fees and refunds are subtracted. Therefore, if you add those items back, you’ll be closer to the amount you’re trying to report. Taxes are different and depend on your tax jurisdiction, you may want to speak with your CPA on this. Though generally, what Airbnb charges the guest is between Airbnb and the guest tax-wise. But then anything they pay out to you (before host fees plus any added taxes) is what you really need to be concerned with for your reporting.

2 Likes

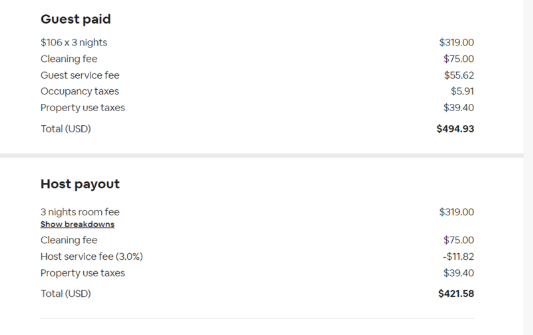

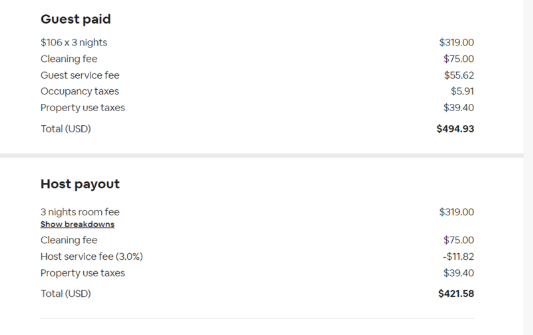

Thanks Robin. My issue comes in the reports that airbnb has for us to download. They do not show the nightly rent, they bury it in the payout. Here is what the reservation says:

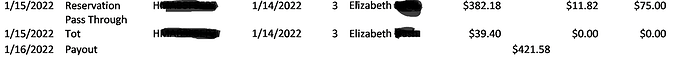

Here is what the airbnb transaction report shows:

To be clear, what the guest paid is not your gross and the “Guest Paid” section is usually irrelevant in tax reporting. The guest service fee is between Airbnb and the guest only. For reporting, you should be primarily concerned with the Host payout section. You should add back the host fee from the total and remove the property use taxes, and this should get you closer to your gross. Be sure to check with your CPA/accounting advisor to confirm.

The reason I say to remove the property use tax is because this is considered a liability rather than income, as it is owed to your tax authority, and should be paid to your tax authority.

1 Like

It does get me closer but I would be much closer if airbnb would have all of the clearly defined amounts shown in the reservation transferred to and then provided to us in the transaction download. I do understand that the gross does not include the guests fee to airbnb. However the $106/night for 3 nights is not reflected easily anywhere in the airbnb reports they have for hosts to download. The rent per night is a critical part of the equation and it is not clearly provided to us.

I guess I’m missing what you’re saying, because it’s pretty clear to me from the CSV, but I always edit it a bit with google sheets to make it more clear.

I know, it is confusing. I too can manipulate the csv but I would not have to if airbnb sent it to us more clearly. For instance, in the csv I will have the figures $382.18, 11.82, and $75. On the reservation I have the figures (nightly charge) $319, clean $75, host fee -$11.82 and the taxes of $39.40. In order for me to get the csv to calculate the nightly room rate ( a key piece as you do your taxes, and clearly shown in the reservation) I have to tell the csv to take the $382.18, add in the $11.82 (fee), then subtract the $75 (clean) to show that of the $382.18 ONLY $319 was rent. Airbnb could simply do that for all of us. To date they have chosen not to.

You report the cleaning fee as income. That was paid to you. The portion paid out for cleaning is then a deduction on your tax returns as an expense against income. Why is the nightly room rate a key piece as you do your taxes?

2 Likes

Good morning. Yes, the cleaning fee is easy to track as it is shown as a separate line on the airbnb spreadsheet. On IRS Schedule E Line 3 I also need the “rent received” as a specific separate item, then the cleaning and owner fee, etc all come out as separate expenses. On the reservation the rent received is the $319 in my example but unless I open each and every individual reservation to find it I have to figure out how to manipulate the airbnb spreadsheets to calculate it.