I am on a disability pension and am trying to access some extra income by putting my whole villa up for bnb twice a year. Can anyone tell me how much I can earn before it effects my fortnightly pension?

From Northern New South Wales.

If you go on the Centrelink website, it will tell you what your earning capacity will be, or have a chat to the in house financial advisor.

BUT!

You may need a different insurer as most household policies won’t cover you and may drop you.

You will be affected by capital gains tax when / if you sell, as you you are now earning an income from your home.

You also need to check if you need a DA or if your council requires registration.

I think that this is the most important part of the post.

A couple of times a year is likely to have very little effect on Capital Gains. Do you need to lodge fortnightly reports to Centrelink? Do you have a mortgage?

Hi Johnny,

I do not have a mortgage and am unable to work anymore because of medical conditions.

I have a lot of medical expenses and just wanted a bit more income than what the pension amount is.

I probably wouldn’t want to earn more than $4000 a year.

Do you think my pension would be affected?

The reason that I asked about fortnightly returns and mortgage is that in the Income and Assets section of the Centrelink site there is a section for entering how much you earned from ‘Boarders and Lodgers’. After you have entered the income that you have received from this source over the past two weeks you are then asked how much interest you paid on a mortgage over that period. In our case we pay about $550 in interest per fortnight and that cancels out any income we have received so we get the full age pension.

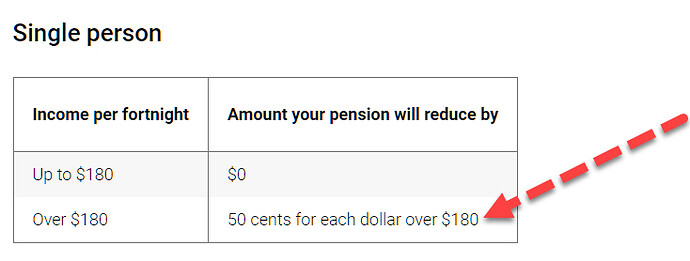

As you don’t have a mortgage it would seem that you lose 50c in the dollar from your pension for every dollar earned over $180.

Do you have to submit fortnightly reports?