This is what happens when you combine visionary disrrupters with clueless bureaucrats.

May be Airbnb is taking a tiny bite out of hotels business but I am watching them very closely, and hotels are not even close to suffering from Airbnb competition.

Most holidays and weekends hotels here on South Florida are elevating their prices quite a bit and sold out . Under 100$ there are very few left over weekends and holidays they are booked weeks ahead.

South Florida is becoming a number one destination for spring breakers and international tourism and there is not enough accomodations for a reasonable price left. Motel 6 was sold out at 300$ a night over February and March, that’s how bad it got here.

I just was booked solid over New year and further for 125$ a room , and I was the cheapest out there. I put that price thinking,what the heck, others do It why I can’t try:)

I’m visiting Washington DC in January… I’m taking my son to his Senate internship (!!!Yay, can I be proud!!!) and I just booked a Hyatt for 87 per night for 9 nights. Free breakfast, no deposit. King bed. No cleaning. Free wifi. Great location! Oh I can cancel for free two days before check in… I’m happy with that. I would not even think of looking at “you-know-where” for a room!!

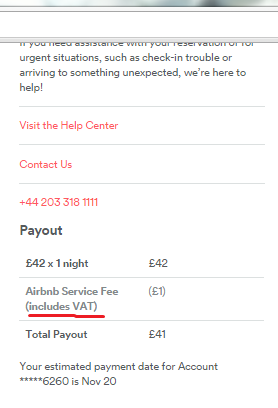

its VAT and airbnb takes it out

@konacoconutz

By any chance is that the Arlington one?

KJ No–why do you ask ? I didn’t want to be outside the city. I used to live in Vienna, Virginia, a burb of DC as a kid. I have not been back for ages! Yes, I know it’s the middle of winter, so that’s why the price is lower.  Still looking at this property …and others… since I can cancel…

Still looking at this property …and others… since I can cancel…

Any recommendations? I want to keep it under $100 a night…

The VAT addition is interesting. I wonder if they charge that to my international guests?

No it wouldn’t get charged to your international guests… they’d just pay the Air service fee. Here in the UK you can potentially set your Air up as a proper business and claim VAT back on things like cleaning, the VAT from each guest etc…

Oh no I was just wondering as we stayed at the Arlington one in Feb (absolutely freeeezzing then). The walk to the city was lovely. The breakfast is really good and I would assume it would be the same as the Hyatt in the city.

I was advised to stay in the city? How far was the walk? I remember Arlington being near where I lived in the burbs but it was not walking distance. I remember having to cross the Potomac River?? Must look at a map. It certainly is cheaper to be outside the city but then we’d be on the metro all the time!

Funnily enough when I was looking at hotels in the area Tysons Corner came up! That’s a stone’s throw from my old stomping grounds. In a way I’d like to keep my childhood memories intact and not go back to see how much an area has changed in all these years.

I can still cancel the Hyatt. If I found something better.  Nearly all of the reviews says it’s a good hotel but in an up and coming area… Not far from the metro. We need to be near the Capitol Hill area because that’s where my son will be working, and where his intern housing is located.

Nearly all of the reviews says it’s a good hotel but in an up and coming area… Not far from the metro. We need to be near the Capitol Hill area because that’s where my son will be working, and where his intern housing is located.

Yeah I guess it is a bit far 40 or so minute walk you can catch the underground which is right by the hotel. We caught it 2-3 times as it was too cold a few days. We stayed out there because it was cheaper. The walk to the city is past some memorials and the National Cemetery (which I found interesting…).

Can I ask you something? Would you have your guests sign a waiver of liability for using snorkeling or beach gear? I was thinking I might ask them to sign it upon arrival.

Thanks! Your description sounds like Jimmy Buffet oughta be singing it.  We also have bike rentals in Kona… About $25 a day for your typical beach cruiser.

We also have bike rentals in Kona… About $25 a day for your typical beach cruiser.

Maybe I am being overly cautious… But we recently had this happen:

County settles lawsuit over Punaluu drowning

Published November 7, 2015 - 1:30am

Pin It

Updated:

November 7, 2015 - 1:30am

Tides roll in at Punaluu Beach on April 20. IVY ASHE/Hawaii Tribune-Herald

By Nancy Cook Lauer West Hawaii Today

HILO — Hawaii County has closed the book on a negligence lawsuit stemming from a 2008 honeymoon tragedy at Punaluu Black Sand Beach.

The County Council in executive session Tuesday agreed to pay Catherine Sneyers, of Hasbrouck Heights, N.J., $20,000 to settle the lawsuit after she appealed 3rd Circuit Court Judge Glenn S. Hara’s Feb. 6 ruling dismissing the case. Hara ruled the county had no duty to post signs warning of dangerous rip currents on private property near the county-managed beach, according to court transcripts.

Sneyers’ husband, Edward R. McCarthy-Slaughter, 40, drowned in high surf while snorkeling with his wife about 100 yards offshore. They had entered the water near the concession area, which is not owned by the county.

Sneyers, represented by Honolulu attorney John Edmunds, said the county had a duty to place surf warning signs there because it had apparently posted signs at that spot telling beachgoers not to take sand from the beach and to keep a distance from the turtles.

She sued for negligence, wrongful death and loss of spousal and parental consortium, seeking unspecified damages that could have exceeded $1 million, according to attorneys in the case.

The county had posted warning signs on the county property itself and had already planned to add a lifeguard stand to the beach before McCarthy-Slaughter drowned.

Edmunds said Friday his client agreed to settle the lawsuit rather than have it drag on. He said he gave up his fees and accepted reimbursement for only a fraction of the costs because his client is the sole supporter of two children.

“I believe strongly in this case, but it is a very difficult case on appeal,” Edmunds said.

The lower court judge had dismissed the case on a motion for summary judgment, rather than have the case proceed through trial. Hara agreed the county had a duty to warn beachgoers of strong currents and other dangerous conditions adjacent to the beach park. But that duty stopped at the property lines, he said.

“Once you have a danger adjacent to that beach park, it gives rise to the duty to warn,” Hara said at the Feb. 6 hearing, according to transcripts. “(If I am the county), and — and let’s say there are dangerous conditions all along that coast, how far down do I have to warn people, you know, you can’t go swimming two miles down, mile-and-a-half down from this park?”

Deputy Corporation Counsel Laureen Martin said Friday that settling the case was a prudent action.

“Although the county was hopeful it would prevail on appeal, there is no guarantee that it would have,” Martin said. “There are also potential weaknesses in the case, which warranted consideration of a reasonable settlement. Ultimately, this settlement avoided significant risks and uncertainty. The amount is also far less than the costs the county would have incurred in order to defend the action.”

People here were pretty pissed at having to fork out 20k to an idiot visitor who snorkeled in extremely rough water, in a known dangerous beach and even entered the water off private property but still chose to sue the county. The Feds have also been sued because idiots have ignored all warnings in Hawaii Volcanoes National Park and have gone off the trail and got injured and died. Why is your idiocy in getting drowned or falling into volcanic crevices the taxpayers’ responsibility? Despite abundantly clear warnings!!!??

That beach park is a place where only experienced swimmers should venture, and there are signs everywhere… Just not at the point (which was NOT EVEN on county property) where the doofus insisted on snorkeling and yet his grieving widow tried to get a million from the county. Go back to New Jersey and stay there!!!

This beach is nowhere near me, by the way. It’s at an east-facing part of the island. Kona means “lee” and that’s why the Kona Coast in general is calm. I always tell my visitors to go here because there are turtles lying on the sand all the time, but not to swim. I can’t believe anyone with common sense would stand there looking at that rough surf and make a decision to snorkel (which takes your attention away from the conditions of course.) You see locals surf there… but it’s for experienced swimmers only. This is how the beach park typically looks. How can anyone snorkel in that?

The circuit court judge rightly dismissed it but the county feared they would not be so lucky with an appellate judge. Either that or it would take 20 grand to fight it on appeal, only to have it dismissed. How generous of the opposing attorney to drop his fee. Jerk. And he’s Hawaii-based too. Doesn’t he realize the counties are strapped and it just hurts everyone to take on cases like this. He should have told the widow, no you don’t have grounds. Condolences, but go away.

I know of some vacation rental properties here on the west side that have kayaks or SUPs included along with their rental. And have no additional waivers for guests to sign. I can’t believe anyone would be that stupid. Kayaks are a huge liability!! So far no incidents…but again, people are idiots.

Thanks for your input on this…

By the way, I could be wrong, but I think I only need to worry about American visitors suing. I don’t believe foreigners can. I think I will make up a waiver for Americans and just have them sign it when I check them in.

So as I understand Florida Tax, Airbnb charges the occupancy tax. I went to file for a license, and they told me since I am not filing the tax, I don’t need one. Air bnb gets the coupons and files it. I do need to pay the sales tax out of my pocket. I filed for that. So my question is, do we list the sales tax separately? How? Do we include it? Thanks for the information. Let me know if I don’t have something correct.

Really? They told you since you are not filing tax, you don’t need a lisense? I thought you have to have occupational lisense anyway, because we have to go by the rules and regulations.

Sales tax should not be coming out of your own pocket. sales tax is paid not by you but by your guests. You collect them and pay quarterly of twice a year, depends on a amount

I went to the occupancy tax office and they said since I am not paying that tax, I do not need the license. The company paying the tax gets coupons they must use when they file. If I get the license, I must pay the tax even if Airbnb says that they are paying it. So that would mean I double pay it.

I am really confused. We have occupancy and sales tax. But the state says they can be called the same thing. LOL. One is 5% and one is 6%(usually called sales tax). How do I know which one airbnb is paying and which one I am supposed to pay?

How do you charge your guests for sales tax? Separate line item? Do you ask for the money when they arrive? In cash? How do you handle it? I have been using instant book, and it seems I cannot add it to that reservation. Or I cannot find it. Help?!?!

I really hope Hawaii never authorizes Air to collect accommodations tax on our behalf because we also have to collect another tax, called excise, for a total of 13.42% in my county. The guest doesn’t know there are two different taxes, and it’s just easier to tell them that this is your tax amount due. Then they pay me, I pay the state (with two separate tax forms, but guests don’t know or don’t care about that) with one check and it’s all good. Easy.

As long as you disclose a million ways that you have to collect tax in cash upon arrival and give the guest that amount up front before they book (I send it with my response to the first inquiry, and again when I send them the guest info document. When they arrive I have an envelope ready with the amount written on it. I always greet them in person and I ask them in the guest doc to have it ready upon arrival so we can get that unpleasantness out of the way and they can enjoy their holiday.)

I know we disagree on this, but it is listed right on Air’s website that collecting tax in cash is one acceptable way to do the deed. Many of my guests have done this at other rentals. I have my license framed and displayed in the room so they know I’m not scamming them for extra bux.

I’ve only had one guest act “surprised” upon arrival that there was tax due, which means they obviously didn’t read any of the many notices I give up front about tax, and they were the rotten Canadians who stole supplies from my room and called me tired and filthy in private feedback and were my second worst guests ever. ![]() A guest a couple of stays ago did ask me about the tax, and I explained in detail what I had to do, the two types we have to collect and why it needed to be in cash and the guy immediately “got” that otherwise it would “pyramid.”

A guest a couple of stays ago did ask me about the tax, and I explained in detail what I had to do, the two types we have to collect and why it needed to be in cash and the guy immediately “got” that otherwise it would “pyramid.”