Has anyone tried SafelyStay for insurance coverage?

$6 per night… Might be a bit pricey. Only covers the continental US so would not help me.

Have you looked into Proper @konacoconutz ?

I haven’t. Have you?

No, but I’m going to tomorrow. Figuring out insurance has been on my list for awhile and I need to finally get it taken care of!

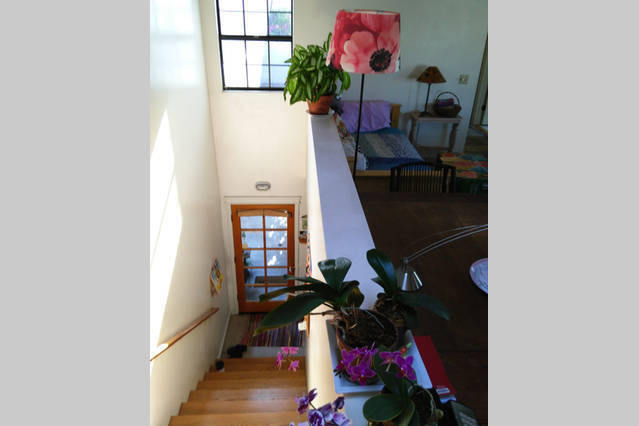

I’ve got the lovely to look at but dangerous as heck uncarpeted oak stairs leading up to my place, so this is a relief to hear. I just assumed that Airbnb, with all its fancy legalese language that of course I never read, would find a way out of not covering this kind of claim.

Yes they do cover you… But you have guests from other platforms like FlipKey or Glamping you would need additional insurance.

Most Home Insurance cater for Homeowners not people in the STR business sector.

Some of those covers mentioned are add ons, not a replacement for proper cover.

Basically you are looking at the same Insurers who for example cater for B&B’s, same sector.

AirBnB, well the Host Guarantee certainly should not be relied on, the Liability Insurance I do not know, bot seen a claim made and reported.

Some Home Insurers will cover STR as an add on, seemingly if it is minimal.

I don’t think you will ever find an insurance that would cause fire damaged to your house caused by your guests. Your insurance can cover the damage to your property or to your guest when you are the responsible one. Same with car insurance, if somebody is responsible of a car accident his insurance has to pay not yours

That actually isn’t the case everywhere. Massachusetts, for example, is a no-fault state. Your own insurance pays when there is an accident regardless of who is at fault.

wow, I have never heard about this, in Massachusetts insurance companies must be very generous! Here in Europe insurance companies trying their best not to pay, even if they have to! In many cases you have to submit an appeal and bring them to the court for them to get pay!

It isn’t about generosity; it is the law. Now, after an accident the person at fault will pay far higher insurance rates in the future. But the person who was not at fault will not.

I understand, is this just for car insurance or also for home insurance?

Just car insurance. Cut way down on fraud, strangely.

Farmers Insurance has a new and competitive Vacation Rental package through Foremost designed specifically for the exploding short-term rental market through platforms such as AirBnB and VRBO. Many People who are renting this way do not realize that if they have a claim, it may not be covered under their current policy and if you do have a commercial policy for your property, it often costs twice as much as the program we are offering.

The program covers properties rented for residential purposes with a lease agreement less then 12 months (daily, weekly, or monthly). The dwelling may also be used by the owner for their own vacation purposes.*

If you own a vacation property, you can get a specialized policy that provides the coverages you want for your particular situation.

Any age home is acceptable

High liability limits, up to $1,000,000 are available, Including Personal Injury (in most states)

Loss of Rents coverage is available

-If you have a claim that results in the loss of use of your property, Farmers will reimburse you for any cancellations or lost booking opportunities for the duration of the repair period. (customizable limits)

Customizable personal property coverage for non-owner occupied dwellings

Extends replacement cost coverage past 30 days to 90 days without vacancy reductions

Dwellings values up to $1,000,000 may be acceptable

I currently insure vacation rentals in the state of California, operating out of the Farmers Insurance agency of Mike Fraijo. If your vacation rental is located in the state of California, I would love to provide you with a quote. If you are in another state, I am sure a Farmers agent in your area would be happy to assist you. My business information is as follows, anyone on this forum is welcome to contact me:

Rebecca Clark

Farmers Insurance, Mike Fraijo Agency

Rebecca.mfraijo@farmersagency.com

562.497.1070

7021 Katella Ave, Stanton, CA 90680

https://agents.farmers.com/ca/stanton/michael-fraijo

I am an insurance broker and also an Airbnb host in the Chicago area, I’m licensed in Illinois, Texas, Florida, Michigan, Colorado. I recently redid my own insurance coverage because I had standard policies.

The market for this sort of thing will change over the next few years.

Some of the companies I know write policies Foremost and American Modern. There are also a variety of different programs underwritten at Llyods. There are a few other carriers with programs as well. Foremost and American Modern do the most rental properties in the country.

I am an insurance broker and also an Airbnb host in the Chicago area, I’m licensed in Illinois, Texas, Florida, Michigan, Colorado. I recently redid my own insurance coverage because I had standard policies.

The market for this sort of thing will change over the next few years.

Some of the companies I know write policies Foremost and American Modern. There are also a variety of different programs underwritten at Llyods. There are a few other carriers with programs as well. Foremost and American Modern do the most rental properties in the country.

Toll Free: 855-657-8400

Chicago Office: 773-657-8400 x 1

Fax: 773-657-8401

karstensfinancial.com

It’s important to remember that renting out your home as a short term vacation rental constitutes as ‘business activity’. A typical homeowner’s policy is a personal policy that has specific language to exclude coverage for business activities within the home. Simply having a rider on a personal homeowners policy is fundamentally wrong for a short term vacation rental, since pretty much every homeowner’s insurance policy has what is called a ‘business activity exclusion clause’. This is specific verbiage within the policy that excludes claims coverage when the homeowner is conducting a business within their home. Even if your agency doesn’t cancel your policy, they will most likely deny any claim you might have- Even if the claim has nothing to do with a renter destroying something within the home. The reasoning behind this is homeowner’s policies are personal policies, whereas specific insurance like Proper Insurance (https://www.proper.insure/) is a commercial policy that covers everything you need.

Here is some information regarding the Foremost policy being ‘the best’ (maybe for price, but you pay for what you get)

Proper Insurance Vs Foremost: The Foremost program is good, but it’s fundamentally wrong for the future growth of short-term rentals and growing regulation. It is a DP dwelling landlord policy that carries premise liability. It is NOT a business insurance policy and does NOT carry commercial general liability. The Proper Insurance® policy is a business insurance policy written on business ISO forms, and does carry commercial general liability.

Commercial insurance is superior to dwelling landlord insurance to begin with, then we add up the Proper Insurance® enhancements, you now have the most comprehensive short-term vacation rental program on the market. A business insurance program specifically written for STR exposure that suffices any and all regulations. A program that covers triple use of the STR property; when it’s rented, when it’s used personally, and when it’s vacant.

Here are a few additional highlights of Proper Vs Foremost: These comparisons were made from a 2017 sample DP3 Foremost vacation rental policy.

The following is a list of things that Proper Insurance®/ Lloyd’s of London PROVIDES, that Foremost EXCLUDES

Commercial general liability

Personal liability when STR doubles as primary residence

Commercial personal and advertising injury

Special form all-risk coverage – Personal property

Automatic replacement cost – Personal property

Automatic Back-up sewers and drains $25,000

Actual loss sustained business income with no time limit

Automatic ordinance or law – Increased cost of construction

Vacancy clause removal

Liquor liability coverage

Liability continued to amenities off-premise (bicycles, golf carts, etc)

General liability continued off-premise (i.e dog bites)

Sexual act or sexual molestation coverage

Suffice for CGL city STR permit requirement

@tmstults please stop spamming the threads for Proper Insurance. A little information where asked for is fine, 8 posts in 24 hours pimping your product is not.

I have Proper Insurance at the moment but got hit with a 20% premium increase this year (no losses or claims). I’m seriously considering Slice since my rental pattern is heavy use in the summer but then dropping off significantly in Fall and Winter. At $5/night, it would be a pretty big savings for me. Anybody else have experience using Slice ?

JK, Thank you for your info. I’m hearing bad noise about Foremost but have spoken with American Modern and they seem pretty buttoned up. Proper is very nervous about writing policies in So Cal, where I am from, because of the fires last year. Slice seems like a great alternative for folks ramping up to to the point where they need full coverage, though AM, for what they are offering, are not that much higher than my regular homeowner’s policy. That said, I’m yet to do a side by side of the coverage both offer. Will let you know if that makes a difference.

Thomas