TikTok video reports that Etsy.com sellers have received formal notice from Etsy that their payouts will be delayed because of Silicon Valley Bank’s collapse.

What a strange banking system to have. Are US banks not regulated to protect this happening?

I think Brian Chesky had commented that Airbnb had not use SVB for a number of years.

it’s in the first line, but given the state of journalism, there’s no assurance it’s factual. journalists love to throw airbnb into a story, for some reason it must give them clicks, i think some people have a fascination/desire in seeing Airbnb fail.

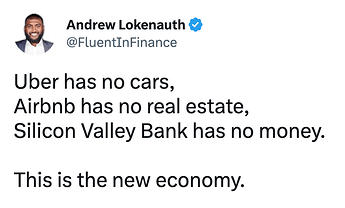

also was googling this topic and this popped up. ![]()

Yes, there are laws.

Here’s what happened (from me, a former banker/bond broker and a VC friend of mine).

SVB is a bank whose customer base is VCs, their clients, and other investment firms. SVB has minimal private customers like us.

SVB locked themselves into a 30 year fixed rate on the 30 year government securities and the yield in this market with interest rates on savings and loans rising, meant that the interest on the Long Bond (as the 30 year is called), didn’t cover them.

So they went to Goldman Sachs to raise $42 billion to cover and exceed their gap as well as provide liquid capital to invest in higher yield financial products.

UNFORTUNEATELY the CEO of SVB decided to sell BANK STOCK OPTIONS at the same time, spooking investors, Venture Capitalists, and causing a catastrophic run on the bank. Meaning that many companies whose VCs used SVB and had to use SVB (too long to get into how private equity works so I’m not doing it. Get an MBA! ![]() ) and had accounts over $250,000 (Federally insured), were now cash poor as the US Banking system allows banking institutions to only keep 10% cash reserves (watch the banking run scene in “It’s A Wonderful Life” with Jimmy Stewart, it’s a quick education).

) and had accounts over $250,000 (Federally insured), were now cash poor as the US Banking system allows banking institutions to only keep 10% cash reserves (watch the banking run scene in “It’s A Wonderful Life” with Jimmy Stewart, it’s a quick education).

Now the Big 3 banks are being pressured by the Federal Reserve to buy SVB and prop it up. (Bank of America, Wells Fargo, JP Morgan Chase).

Oh, and in typical Goldman Sachs style, they bailed from their contract when the CEO of SVB decided to sell stock instead of sticking around to help with the damage.

Questions? Line them up and I’ll be back after 7pm EDST. Or DM me.

Thanks for the detailed explanation. @casailinglady Some interesting responses from UK banking sector.

Quickie - Trump isn’t the one responsible for the biggest rollbacks - that was the Clintons.

Thank you @casailinglady !

I heard that SVB handed out bonuses just days prior to being shuttered by the FDIC. What do you make of this?

I’ve also heard this CEO was in a C suite for Lehman Brothers when it failed. Do you think the selling of bank stock options was a deliberate move to bring about the current situation?

Thank you again :))

This article reminds me of how all the rental arbitrage and investor hosts with dozens of listings were screaming so loud when Covid hit and all their bookings were cancelled.

I hadn’t heard from my VC friend about that. I doubt it’s true. Bonuses are distributed year-end.

If he was in a C Suite, it could be because Goldman bailed.

VCs aren’t parasites. They’re the ones that get companies like mine off the ground. (hedge funds can be parasitic). They capitalize small businesses, guide them, help them employ people, and create jobs.

BTW, it’s not a tantrum when a bank folds due to illiquidity - now those VC-funded companies can’t pay their bills. The VCs have a vested (literally THEIR OWN MONEY) interest in seeing their clients suceed.

On Friday, executives of SVB were “busy paying out congratulatory bonuses hours before the Federal Deposit Insurance Corporation rushed in to take over their failing institution” — leaving countless businesses with accounts “alarmed that they wouldn’t be able to pay their bills and employees,” Warren continued. (SVB CEO Greg Becker, who earned $9.9 million in compensation last year dumped some $3.6 million in stock just days before the bank imploded, Bloomberg reported.)

Actually, Dodd-Frank, which was a protection that was signed by Obama after the 2008 banking crisis was rolled back in 2018 by then President Trump.

At the behest of a Democrat-led House and Senate. The Clintons rolled back Glass-Stegal and forced banks - especially small ones - to sell sub-prime loans to people who had no money down, a crushing 5 year balloon payment, and inflated property values everywhere - while touting home ownership as the American Dream.

At the end of the day, the CEO’s irrational decision to also sell stock instead of listen to Goldman (or Lehman) led to fear-based uncertainty and a bank run.

Correction: There was no legislation rolled back by “The Clintons”. Hillary Clinton did not become a senator until after Bill Clinton’s presidency, so she had no role in proposing or approving any legislation during Clinton’s presidency.

That’s really funny ![]() And a very astute observation

And a very astute observation ![]()

But, wait, their kid was very precocious so are we sure? ![]()

And don’t tell me that Buddy wasn’t tres suspicious:

You’re incredibly naive if you think Hillary wasn’t in on any and all policies under her husband’s tenure. And that’s all I’ll say about this. As for @JJD’s snark, all I can say is “Really???”

Let me state again, I was in the banking and bond business working on the Fed’s inter-dealer side of the business (brokering the trades between the banks required to buy and sell the Federal bonds), then spent 8 years with Fidelity Investments in Operations and Marketing and have several friends who are Venture Capitalists (meaning they invest their and other people’s monies into start ups and small businesses - NOT hedge funds, of which I am not a fan). I’ve seen a lot from the view on a trading floor, so I’m trying to help you that don’t have that information understand what happened and not the noise that is the “news.”

There are a myriad of reasons why SVB failed and other banks are failing. And some of it has to do with very old standing banking regulations that require banks to hold a majority of their assets in “stable, long-term (30 year) approved assets.” To most of these banks, that means the 30 year bond, and the interest rates of the 30 year fluctuate with market moves.

Meaning the interest on the 30 year drops when the Fed raises interest rates (making short term CDs, stocks, and other financial instruments better paying). Stock market up, Fed bonds down. So they want to get out of the 30 year, but they can’t so they have to find other ways to raise the cash to get into higher-yield financial instruments. So they sell certain assets such as C stock to not alarm the marketplace. Until some daft CEO talks to the press.

These laws are in place so that banks can have “more secure” investments in the long term and have their 10% cash reserves have a steady income.

The crisis comes when the 30 year yields drop below operating costs, which rise with interest rates, the price of gold, and oil-based commodities.

I hope this helps. Leave your abuse at the door - you’re all capitalists if you’re running an STR *business.*strong text ![]()

Any other former bankers here?

Are banks really required to buy 30-year Treasuries? They’re not allowed to buy 2- year, 5-year, 10-year bonds?

I’m surprised but you’re the expert.

Thank you for your very informative post.

Snark? I don’t understand where you’re coming from. It was obviously satire, specifically a device called “incongruity”. Although of course spouses of presidents have influence over the president, the idea that a dog would be involved in making policy is absurd (that’s the incongruency). Snark on the other hand would require mocking, insult, criticism and a specific target, none of which existed in my comment.

TL; DR: It was a joke ![]()

Of course most married couples discuss their work with each other and seek support and advice.

But Hillary Cinton did not “roll back” any legislation during Bill Clinton’s presidency, as you claimed.

Yes, he did. Right away, “no exposure to SVB”. So both the posted article and the title of the post are incorrect.