Has anyone else had a problem with AirBnB collecting far more in tax than they are supposed to? 2 nights- $224= $73+ collected. The new tax is 7% in an area where there are super high property taxes for a historic property. It’s bringing local STR owners to their knees in this unsupported extra cleaning Covid climate. Pretty much have to pay Guests to book, so I had to sell the house—hope I can return to hosting as I really enjoy it!

This is something that your town/city/county/state decides and levies - airbnb has nothing to say in the matter.

I’m not questioning their say in it, but rather the math—

Isn’t there an option for you to bypass Air collecting and sending the tax? That way you can do your own math. Also, the tax should come out of the guest’s portion?

0.07% tax should be around $16 on $224. And that should be added to the guest costs, not yours. If air is deducting $73, you need to talk to them.

You may want to see what your town uses for their ‘math’. In my town, there is occupancy tax, sales tax, etc factored in. But as I mentioned the tax collected for the town is what the town requires, airbnb has nothing to do with that. Sorry about your property taxes, though.

I was wondering if anyone else had encountered this and had success contacting Air. I have contacted my local government and they’re supposed to get back to me. Not holding my breath! Do you know anything more about the option to bypass for further endeavors? I didn’t see where I had a say in the matter—

I have contacted them and am supposed to hear back. I do have high cleaning fees, but the local gov thought they shouldn’t be included. I’d love to have Air and the gov talk to each other rather than have me be the liaison–

You might want to talk with your accountant. Fees paid to airbnb are based on what the local gov’t sees as income, and yes, perhaps your cleaning fees are being included unjustly, but ultimately everything you earn is income and it is up to you to find deductions etc. Perhaps your local town taxes will be partially returned? In the US tax refunds are a fact of life…

Thanks, but the math would still not add up. The gov does charge $5 a night, too, but even if I include that and the cleaning fee, it still doesn’t add up. Hoping someone else fought and won a similar problem and could give me some advice, though I certainly wouldn’t wish it on anyone!

Cleaning fees, extra guest fees, pet fees, etc are usually taxed the same way that the nightly rate is taxed. Basically anything you charge the guest to stay that isn’t refundable (like a refundable deposit) is taxed.

Just to clarify, are the taxes you’re referring to what Airbnb charges your guests? Or is Airbnb withholding taxes from your payouts? I only ask because it’s awfully close to the “up to 30%” that they withold if you didn’t fill out your W-9.

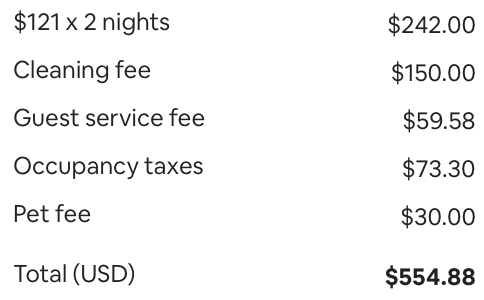

I did fill out my W-9 and it’s clearly marked as occupancy taxes— here’s a screenshot:

Thanks. It wasn’t clear to me. So that is going to be $422 that is taxed. So that ends up being about 17%. That probably includes your occupancy taxes, hotel taxes and sales tax, that’s what’s included in the line that says “occupancy taxes” in my city, which add up to 16% or something, so yours is not far off if other taxes are included. Do you know what all they are including in there? It is likely more than the 7%.

Have you looked at listings near you that have a similar total price (rate + pet fees + cleaning fees)? Do their taxes look to be about 17% as well? If not, then it may not be a coincidence between 17% and 7%, it’s not unimaginable that Airbnb put the decimal in the wrong place.

Thanks, I will check that out. I believe it is supposed to be only the 7% and $5/night. If that’s their angle to charge on cleaning, then they’re getting double when cleaners pay their taxes and the city did say they didn’t think that cleaning should be included. I hope that will be the case if I’m a squeaky enough wheel— have they always included the cleaning fees in yours? I’m in a smaller town, but that doesn’t keep them from exacting some of the highest property taxes in the state, too. You’d think we were NYNY—

I hear what you’re saying but it is different. The first time the guests are taxed for occupancy and then the cleaners are later taxed on income. You could trace it to the same cash but it’s different parties being taxed for different reasons. I pay tax on a car when I buy a new one but the guy I bought the car from also pays tax on his income from the commission.

Everything is really like this. It’s the same at hotels. Their guests pay tax on the total amount and cleaning is included in that but the housekeeping staff still pays tax on their income at the hotel. (technically neither your cleaners or the housekeeping staff at a hotel are probably not paying taxes because they don’t make enough money to owe taxes, but that’s a different conversation, lol).

I see what you’re saying. I think it’s going to be the end to a lot of local Hosts, sorry to say. I’ll still squeak with local government, though, since they squeeze us so much already. People move away because of the taxes and if they deign to make you a historic property, you have to prove it back to them to get a tax freeze. High property taxes, Covid expenses and fewer bookings at lower rates make it difficult to keep open. Guess I’ll have to go back to being a landlord. T

hanks for letting me vent— I don’t want to be a wet blanket!

My combined sales/occupancy taxes are 14.25%, and yes that’s on all payments received by host.

This is clearly described on my county government website, which may not be the case for all localities.

AirBnB made an arrang3ment with your local government, and set the rate accordingly. Where I live we have a 5% city sales tax + 9% transient occupancy tax = 14%. For 2 years I had to collect it on arrival which was really a pain, but now I can add it to my booking, Air collects it and adds it to my payout.

I suspect Air won’t let you set up a similar payment because of your location (they use the rental address to determine it, so that could be an error if say, you’re in a county that collects but not in a city that also does).

If they don’t refer you to a higher up who can actually take some action, complain on Twitter. That usually gets someone at HQ to wake up.

Why it’s your business?

Why would ‘local hosts’ be affected by the same taxes that anyone pays in the USA?

I’m a bit confused by this topic.

The OP says that the tax in their area is 7% which, if that’s the total taxes due, is very low. Is that just the bed tax though? Ours totals much more than that as there’s also tourist development tax and what they call ‘discretionary sales surtax’ (or similar).

So I imagine that the 7% quoted is just the TOT?

Like @Rolf I don’t understand what this means. All hosts are subject to taxes so it’s a level playing field.

Anyway, it’s a job for your CPA. ![]()